Ieuter Insurance Group Blog

All You Ever Wanted to Know About Insurance

This Weekend is One of Michigan's Two Free Fishing and State Park Entry Weekends

Thursday, February 12, 2026

It's one of Michigan's two yearly free fishing weekends this weekend.Here's some helpful information from the State of Michigan regarding Michigan's two free fishing weekends. All fishing license fees will be waived for...

Meet Michele Nieves Award-Winner Raylene Rice

Thursday, February 5, 2026

Ieuter Insurance Group presents our Team Awesome Awards at the close of the year, celebrating the contributions of our amazing team members throughout the year. These awards are incredibly meaningful to their recipients...

Meet Kim Mayhew Award-Winner Nicole Northard

Thursday, January 29, 2026

Ieuter Insurance Group presents our Team Awesome Awards at the close of the year, celebrating the contributions of our amazing team members throughout the year. These awards are incredibly meaningful to their recipients...

Meet Rockstar Rookie Award-Winner Paige McCollister

Thursday, January 22, 2026

Ieuter Insurance Group presents our Team Awesome Awards at the close of the year, celebrating the contributions of our amazing team members throughout the year. These awards are incredibly meaningful to their recipients...

Meet Innovative Thinker Award-Winner Samantha Gault

Thursday, January 15, 2026

Ieuter Insurance Group presents our Team Awesome Awards at the close of the year, celebrating the contributions of our amazing team members throughout the year. These awards are incredibly meaningful to their recipients...

More 2025 Team Ieuter Awards and Recognitions

Thursday, January 8, 2026

We're so proud of our tremendous team, and our annual Ieuter Insurance Group Team Awesome Awards are a great opportunity to celebrate the many accomplishments of our incredible colleagues. In 2025, a new team member...

We're Hiring for a Paid Internship

Thursday, January 1, 2026

Ieuter Insurance Group is hiring for a paid Internship position. Primary responsibilities include: Answering incoming phone calls with a smile and directing callers to the appropriate department; preparing auto IDs,...

Holiday Hours at Ieuter Insurance Group

Thursday, December 25, 2025

Merry Christmas from Your Friends In The Insurance Business! We are open for a half-day on December 24, and we are closed on December 25 for Christmas. We will also be closed on January 1, 2026 for New Year's Day....

2025 Ieuter Insurance Group Team Awesome Award Winners

Thursday, December 18, 2025

We're so proud of our tremendous team, and our annual Ieuter Insurance Group Team Awesome Awards are a great opportunity to celebrate the many accomplishments of our incredible colleagues. The Rockstar Rookie Award...

What to Keep in Your Car for Emergencies

Thursday, December 11, 2025

Car trouble can strike when you least expect it. Whether you're facing a dead battery, flat tire, or unexpected weather, having the right gear in your vehicle can make a stressful situation more manageable. A well-...

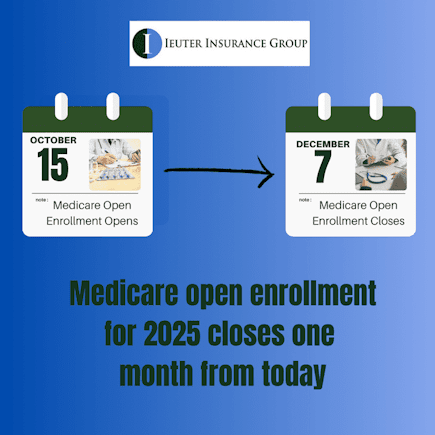

Reminder: December 7 is the Last Day of 2026 Medicare Open Enrollment

Thursday, December 4, 2025

Reminder: December 7 is the Last Day of 2026 Medicare Open Enrollment. If you want to discuss your Medicare questions with a member of the Ieuter Insurance Group team, please make sure to reach out by December 5....

Do You Need To Schedule Any of Your Holiday Shopping Purchases?

Thursday, November 27, 2025

November 28 is Black Friday this year. It's the day after the Thanksgiving holiday and typically the biggest shopping day of the year.When you make pricey purchases, it's always a great idea to reach out to Your Friends...

Understanding Long-Term Care Insurance: What You Need to Know

Thursday, November 20, 2025

As we age, planning for the future becomes increasingly important. One critical aspect of this planning is ensuring we have the necessary coverage for long-term care. Long-term care insurance(LTCI) is designed to help...

We're Hiring! Account Analyst / Welcome Center Representative

Thursday, November 13, 2025

Ieuter Insurance Group, is rapidly growing and is accepting resumés for a full-time account analyst in our personal lines department. Primary Responsibilities: Answer incoming phone calls with a smile and direct to the...

5 Things to Do After Buying a New Car

Thursday, November 6, 2025

Buying a new car is exciting, but once the keys are in your hand, there are a few important steps you should take to protect your investment, stay legal, and avoid headaches down the road. Whether you just drove off the...

Stay Safe This Halloween with These Tips from Your Friends in the Insurance Business

Thursday, October 30, 2025

(Photo: The annual Team Ieuter Halloween costume contest always adds some spice to the holiday! Visit our Facebook account on Halloween to place your vote for this year's best group contest!) Halloween is a night full...

Do You Have Medical Insurance Questions?

Thursday, October 23, 2025

A healthy body is a happy body, and there’s no better way to preserve your health and your family’s health than with a health insurance policy from Ieuter Insurance. Let’s face it, medical treatments aren’t cheap....

Key Dates for 2026 Medicare Annual Enrollment

Thursday, October 16, 2025

Enrollment for Medicare for 2026 opens this week, The 2026 Medicare enrollment period is the Annual Enrollment Period (AEP), which runs from October 15, 2025, to December 7, 2025. During this time, you can review and...

What Every Homeowner Should Know About Their Utility Shutoffs

Thursday, October 9, 2025

Owning a home means taking on a wide range of responsibilities, from mortgage payments to seasonal maintenance. One of the most critical, and commonly overlooked, areas of home safety is knowing how and when to shut off...

Stop By Our Office in October To Support Our Breast Cancer Fundraiser

Thursday, October 2, 2025

Supporting breast cancer research and the fight to end breast cancer is incredibly important to Your Friends In The Insurance Business at Ieuter Insurance Group. If you stop by our office, you may spot our team wearing...

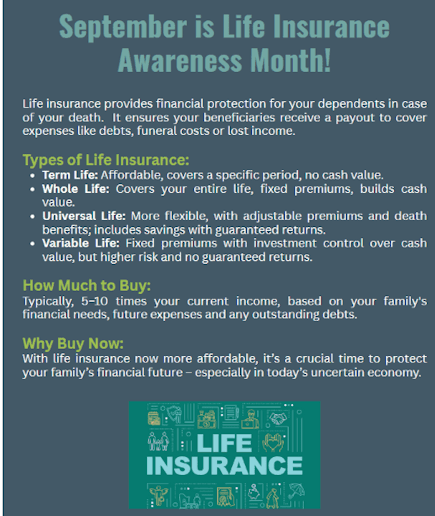

September Is Life Insurance Awareness Month

Thursday, September 25, 2025

Your Friends In The Insurance Business at Midland's Ieuter Insurance Group can answer your insurance coverage questions. For all your insurance needs, visit us at https://www.ieuter.com Ieuter Insurance Group - 414...

School Bus Safety

Thursday, September 18, 2025

Millions of children across the US ride the school bus every day, in Michigan alone more than 533,000 students plus over 38,000 special needs children ride the school bus. While statistically school buses are the safest...

Are You Eligible For Life Insurance Coverage without Exams or Bloodwork?

Thursday, September 11, 2025

Did you know you might be able to get Life Insurance with no exams or bloodwork? At Ieuter Insurance Group, in partnership with Auto-Owners Insurance, we’re making coverage easier through our Accelerated Underwriting...

How to Insure a Travel Trailer or Camper for the Off-Season

Thursday, September 4, 2025

For many RV and travel trailer owners, the fall and winter months bring road trips to a pause. Whether you store your camper in a garage, on your property, or at a designated facility, it's important to make sure your...

Connect with Us 24/7 Through the Ieuter App

Thursday, August 28, 2025

The Ieuter 24/7 App make it easy for you to look at your policy, pull up an auto ID, and submit a claim. Ieuter 24/7 can come in handy, for example, if you get pulled over and don’t have an auto ID on you. If you have...

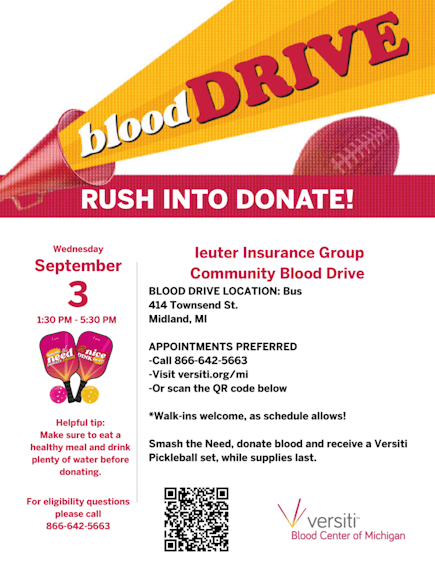

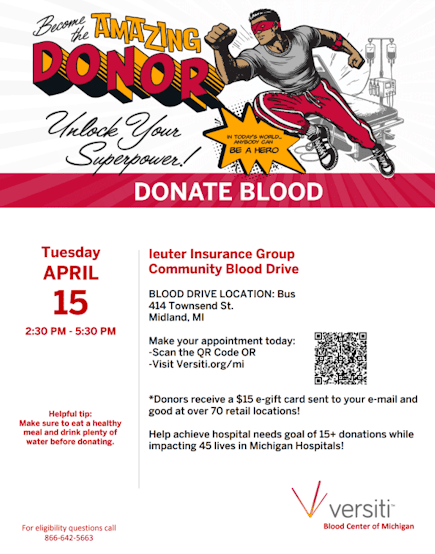

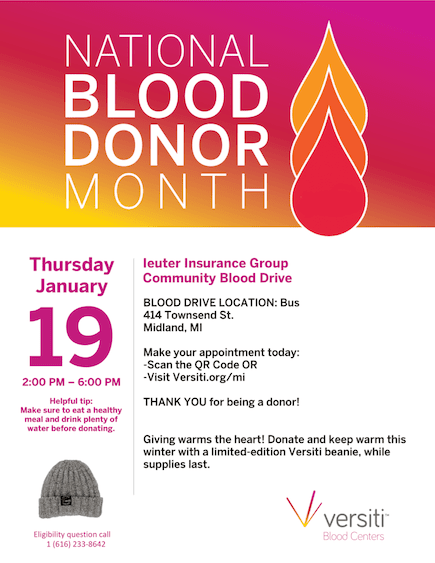

Join Us for Our September 3 Blood Drive

Thursday, August 21, 2025

Your Friends In The Insurance Business at Ieuter Insurance Group hope you join us at our September 3 blood drive, hosted in partnership with Versiti Blood Center of Michigan in the Ieuter Insurance Group parking lot. "...

We're Hiring! Full-time Welcome Center Representative

Thursday, August 14, 2025

Ieuter Insurance Group is rapidly growing and is currently looking for a full-time Welcome Center Representative.Primary Responsibilities: Answer incoming phone calls with a smile and direct to the appropriate...

Six Overlooked Items You Should Add to Your Home Inventory

Thursday, August 7, 2025

Creating a home inventory is one of the smartest steps you can take to prepare for the possibility of a future insurance claim. If your belongings are damaged or stolen, a detailed list makes it easier to verify losses...

How Much Life Insurance Should You Have?

Thursday, July 31, 2025

How Much Life Insurance Should You Have? Life insurance is one of the most essential aspects of financial planning, yet many people find it challenging to determine exactly how much coverage they need. Whether you're...

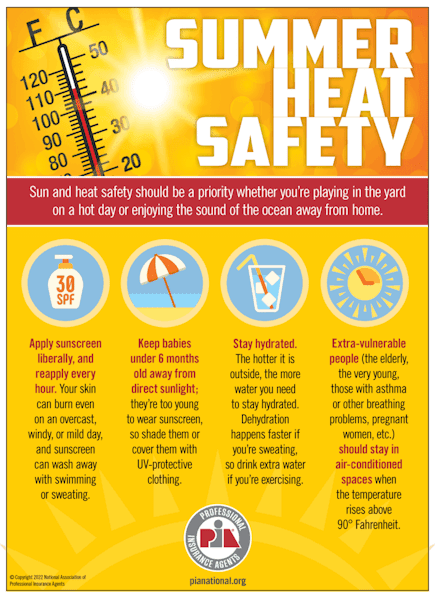

How to Stay Safe When the Heat Index is High

Thursday, July 24, 2025

Sun and heat safety should be a priority whether you’re playing in the yard on a hot day or enjoying the sound of the ocean away from home. Ieuter Insurance Group and our friends at the National Association of...

Car Break-ins Are on the Rise -- Ieuter Insurance Group Offers Tips to Protect Your Property

Thursday, July 17, 2025

There has been a huge rise in theft recently, especially car break ins. Here are a few tips that can help you protect your property and minimize exposure. -Make sure to always lock your windows and doors. -Install...

Backyard Safety Tips for Fire, Water, and Everything in Between

Thursday, July 10, 2025

Summer is the perfect season for outdoor entertaining, family cookouts, and poolside relaxation. With more time spent outside comes more exposure to risks that could lead to accidents and insurance claims. From fire...

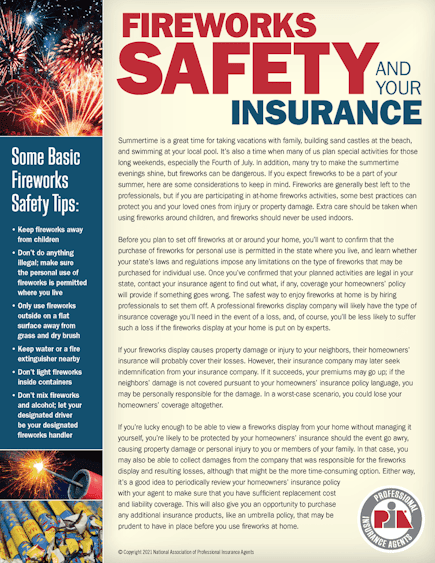

Staying Safe on the Fourth of July Holiday

Thursday, July 3, 2025

Memorial Day might be the unofficial start of summer, but Independence Day is when the season truly kicks into high gear. July 4 is a holiday that has something for everyone, whether you like to host (or attend)...

Michigan PIP – What is it and what does it cover?

Thursday, June 26, 2025

Michigan PIP – What is it and what does it cover? PIP stands for Personal Injury Protection. It is the portion of your Auto Insurance policy that pays for allowable medical expenses if you are injured in an Auto...

Insurance Tips for First-Time Homebuyers

Thursday, June 19, 2025

Buying your first home is an exciting milestone, but it also comes with a learning curve, especially when it comes to homeowners insurance. With so many options and coverages to consider, it’s important to understand...

Ieuter Insurance Group Provides Free U.S.-made Flags for 10th Consecutive Flag Day

Thursday, June 12, 2025

Your Friends In The Insurance Business at Midland Michigan's Ieuter Insurance Group are honoring Flag Day, which is Saturday, June 14, by distributing free American flags at our office in downtown Midland. This is the...

When Was the Last Time You Reviewed Your Insurance Coverage?

Thursday, June 5, 2025

When was the last time you reviewed your insurance coverage? Reviewing your insurance coverage with your agent is important for several reasons: 1. Ensure Adequate Coverage: Your life circumstances may change over time (...

What to Check Before Letting Your Teen Drive the Family Car

Thursday, May 29, 2025

Handing over the keys to your teenager is a big moment-for them and for you. While it marks a new level of independence, it also comes with serious responsibilities, including making sure your insurance coverage is...

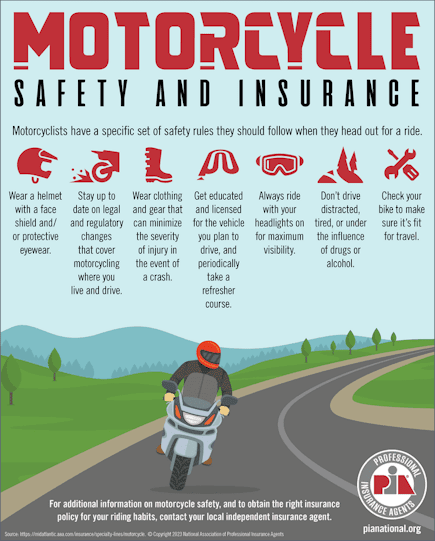

Motorcycle safety tips from Your Friends In The Insurance Business

Thursday, May 22, 2025

It’s Motorcycle season, and May is Motorcycle Safety Month! Now is the time to get refamiliarized with the rules of the road. We have compiled 10 motorcycle tips to help everyone enjoy a safer ride. 1. Watch Drivers'...

Ieuter Insurance Group Earns Prestigious Sapphire Agency Distinction: No. 1 in Region for Auto-Owners Property and Casualty Growth

Thursday, May 15, 2025

- Your Friends In The Insurance Business at Ieuter Insurance Group are proud to be commemorating our ninth consecutive year earning Auto-Owners Insurance's Sapphire Award, which celebrates the top three agencies for...

Planning an Outdoor Celebration This Summer? Ieuter Insurance Group Has You Covered (Literally) With Complimentary Tent Rental

Thursday, May 1, 2025

Your Friends in the Insurance Business recently partnered with Dial Tent in Saginaw to create this awesome 20x30 tent so you can celebrate rain or shine! Call us today to find out how your family, organization or...

Practical Reasons for Purchasing Life Insurance for Children

Thursday, May 1, 2025

Buying life insurance on children might seem odd at first-after all, they usually don't have income or dependents. But there are a few practical and emotional reasons some parents or guardians choose to do it. Here's a...

Staining Your Deck This Summer? Use Caution When Discarding Oil-Soaked Rags

Thursday, April 24, 2025

Summer is quickly approaching and many people use the warmer, drier weather to re-stain their decks. Did you know that improperly disposing of rags used to stain wood is one of the most common causes of house fires?...

Ieuter Insurance Group Named a 2025 Michigan Millers Preferred Partner

Thursday, April 17, 2025

Ieuter Insurance Group has been named one of Michigan Millers Preferred Partner Agencies for 2025. Michigan Millers Preferred Partner Agencies represent the top 15% of Michigan Millers’ agency partners in terms of...

Join us for our April 15 Blood Drive

Thursday, April 10, 2025

Your Friends In The Insurance Business at Ieuter Insurance Group hope you'll join us in making a difference at our next blood drive, April 15 from 2:30 - 5:30 pm at the mobile blood donation center in our parking lot....

Getting Your RV Ready for Spring Travel

Thursday, April 3, 2025

As the weather warms up and the open road starts calling, spring is the perfect time to get your RV ready for travel. Whether you're planning weekend getaways or cross-country adventures, taking the time to properly...

Ieuter Insurance Group March 2025 Newsletter

Thursday, March 27, 2025

In the March 2025 Ieuter Insurance Group Newsletter, we highlight the accolades and accomplishments of our incredible team, spotlight an amazing Midland nonprofit (Phoenix Community Farm), and share insurance insights...

Help Keep Teen Drivers Safe with Telematics

Thursday, March 20, 2025

As parents, the safety of our teenage drivers is paramount. With road accidents constituting a significant risk for young drivers, leveraging technology to enhance their safety isn't just smart; it's essential....

Is Your Home Ready for Severe Weather? How to Protect Your Property

Thursday, March 13, 2025

Severe weather can strike at any time, bringing heavy rain, strong winds, hail, snow, or extreme heat that can damage your home. Preparing your property in advance can minimize potential damage, reduce costly repairs,...

I am renting a car on vacation. Do I need to buy the rental insurance?

Thursday, February 27, 2025

"I am renting a car on vacation. Do I need to buy the rental insurance?"This is one of the questions our clients ask us the most frequently. The answer is that you should have some kind of coverage on the rental vehicle,...

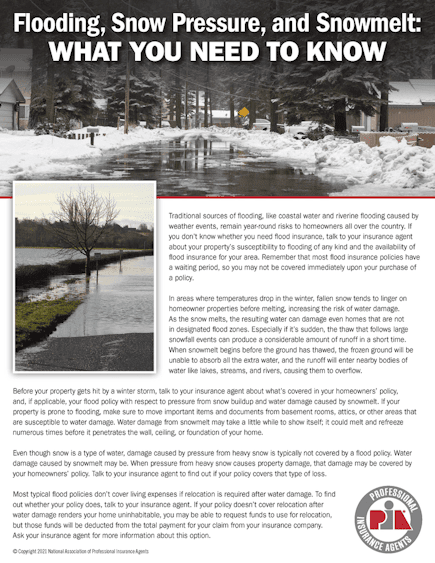

Flooding, Snow Pressure, and Snowmelt: What You Need to Know

Thursday, February 20, 2025

Traditional sources of flooding, like coastal water and riverine flooding caused by weather events, remain year-round risks to homeowners all over the country. If you don’t know whether you need flood insurance, talk to...

How to Extend the Life of Your Roof with Regular Maintenance

Thursday, February 13, 2025

Your roof is one of the most important parts of your home, protecting you from the elements and keeping your family safe. However, it’s often an overlooked aspect of home maintenance. With proper care and attention, you...

Emerging Trends in Identity Theft and How to Stay Ahead

Thursday, February 6, 2025

As technology advances, so do the tactics of identity thieves. Identity theft is no longer limited to stolen credit card numbers or Social Security fraud-it has evolved into a complex web of cybercrime targeting...

Ways to lower home insurance cost

Thursday, January 30, 2025

There are several different options to take advantage of to lower the cost of your home insurance. Reach out to our award-winning team of insurance professionals to discuss possible options for lowering your premiums. 1....

Reducing the risk of vehicle break-ins

Thursday, January 23, 2025

There has been a large surge in theft in the last five years, with car break-ins in particular increasing steadily. Here are a few tips that can help you protect your property and minimize exposure. -Make sure to always...

The importance of reviewing your insurance coverage with an independent insurance agent

Thursday, January 16, 2025

When was the last time you reviewed your insurance coverage? Reviewing your insurance coverage with your agent is important for several reasons: 1. Ensure Adequate Coverage: Your life circumstances may change over time (...

Leaseback agreements

Thursday, January 9, 2025

A leaseback agreement is an arrangement in which the company that sells an asset can lease back that same asset from the purchaser. A lease back agreement is also known as a sale-leaseback. With a leaseback agreement...

Do I need Home Cyber insurance protection?

Thursday, January 2, 2025

How many personal electronics are in your home? The need for Home Cyber insurance is growing at a rapid pace as individuals store more information electronically and access more data online. This coverage provides...

Adding jewelry coverage to your insurance policy

Thursday, December 26, 2024

The holidays are a great time to reassess whether you have any new big ticket items to add to your insurance policy.Jewelry is automatically covered under personal property but usually only up to a specified dollar...

Choosing the Right Umbrella Insurance Policy: A Guide to Extra Liability Coverage

Thursday, December 19, 2024

When it comes to personal insurance, most people are familiar with their auto, homeowners, or renters policies. However, fewer may be aware of umbrella insurance-a type of coverage that goes beyond the limits of your...

What is gap insurance?

Thursday, December 12, 2024

Gap insurance pays the difference in a total loss on your vehicle between what is owed and the car’s current value. Unfortunately, most times when you drive a car off the lot, it depreciates immediately. Most vehicles...

How Major Life Events Impact Your Insurance Needs

Thursday, December 5, 2024

Life's biggest milestones, like marriage, buying a home, or having children, often bring new financial responsibilities and changes in your insurance needs. To ensure you and your loved ones have the right coverage in...

Quick Tips to Protect Your Vehicle from Thieves

Thursday, November 28, 2024

Car theft is a frustrating and costly experience that affects thousands of vehicle owners each year. While most modern cars come equipped with advanced anti-theft features, thieves are becoming more sophisticated,...

Does your home insurance policy offer adequate storm and water damage coverage?

Thursday, November 21, 2024

As we begin experiencing some wintery weather, it's a good time to reach out for a policy review to ensure you're covered for winter storm damage and other types of water damage.Homeowners insurance covers certain types...

Do you have questions about Individual Health Insurance?

Wednesday, November 13, 2024

Shopping for health insurance can be overwhelming. Here’s some information to help you better understand Individual Health Insurance. You can enroll into an individual health plan during open enrollment each year...

The 2025 Medicare Open Enrollment period ends one month from today. Reach out to us with your Medicare questions.

Thursday, November 7, 2024

The 2025 Medicare Open Enrollment period ends one month from today. Medicare is an ever-changing landscape, with many changing factors happening nationally and especially locally. If you'd like to review your Medicare...

Have fun and stay safe this Halloween with these tips

Thursday, October 31, 2024

Keep your family and neighbors safe this Halloween by following these Halloween safety tips provided by our friends at the National Association of Professional Insurance Agents, and have a fun night! Be sure to keep...

Ieuter Insurance Group is hiring for the role of Ieuter Man

Thursday, October 24, 2024

Do you want to be a superhero?🦸 Ieuter Insurance Group is hiring for the role of Ieuter Man. You might be a great candidate if you're reliable, friendly, and looking for part-time hours mostly in the evenings and on...

Wood stoves and loss prevention

Thursday, October 17, 2024

Did you know wood stoves cause more than 4,000 house fires every year according to the United States Fire Administration? Even a small fire can hurt people and pets and destroy homes and cherished personal belongings....

How to winterize and properly store your boat

Thursday, October 10, 2024

Your boat is an investment that gives you tons of fun all summer long. But come the cold weather months, you want to make sure it’s properly winterized before you store it, so it’s protected from weather and other...

Keep up with Your Friends In The Insurance Business in our latest newsletter

Thursday, October 3, 2024

Does your business need Key Man / Key Person coverage?

Thursday, September 26, 2024

Key man life insurance, also known as key person life insurance or key employee life insurance, is a type of life insurance policy that a business purchases to protect itself from the financial loss that may occur if a...

Essential safety gear for motorcyclists: A guide to protection on the road

Thursday, September 19, 2024

Riding a motorcycle offers an unparalleled sense of freedom and excitement, but it also comes with its share of risks. To ensure safety on the road, it's crucial for motorcyclists to invest in proper safety gear. From...

Save Money With These Smart Home Devices That Make Your Home Safer

Thursday, September 12, 2024

Homeowners today have never had more ways to save money through technology. Here are five smart home devices that will help you cut down on your bills and improve your home’s safety. Better safety can mean fewer...

Preparing your teen driver for varying road conditions and situations

Thursday, September 5, 2024

Do you have a teenager taking drivers' education class this fall? If you have a young driver in your home, you may be fearful about them driving on their own, especially in bad weather or road construction. Here are...

Insurance considerations for newlyweds: Merging policies and coverage

Thursday, August 29, 2024

Did you know that September and October are the most popular months for weddings? If you're getting prepared for upcoming nuptials, don't forget add touching base with your insurance agent to your wedding checklist....

Ieuter Insurance Group is proud to be the platinum sponsor of Concert for a Cause

Thursday, August 22, 2024

We're so excited to be part of this incredible fundraising event supporting Gateway Healthcare Family & Urgent Care. Save the date: The event will be held from 1 - 5 pm on Sunday, Sept. 8 at Midland Town Centre /...

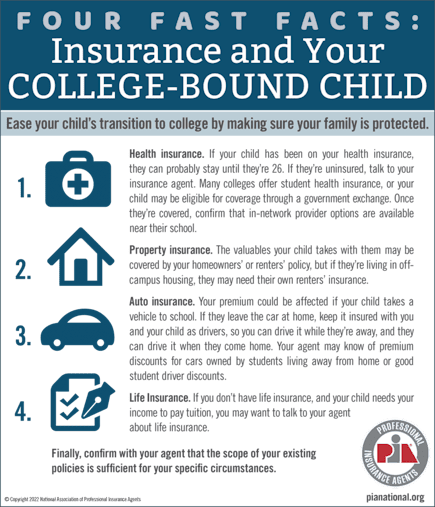

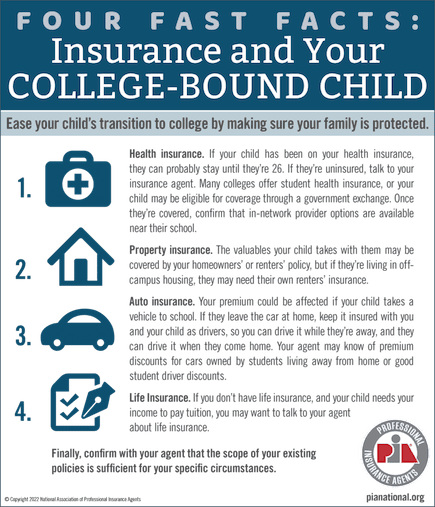

What insurance issues will your child's departure for college raise?

Thursday, August 15, 2024

Do you have kids headed off to college later this month? Do you know what insurance issues their departure will raise? We highly recommend reaching out to Your Friends In The Insurance Business at Ieuter Insurance Group...

Auto insurance coverage and cracked windshields

Thursday, August 8, 2024

Cracked windshields can happen anytime, anywhere. There are many scenarios where you may discover a chip or hole in your windshield. One of the most common incidents that our insureds experience is that they are driving...

Essential Fire Safety Tips for Your Home

Thursday, August 1, 2024

Taking care of fire safety at home is a key part of managing your household. Each year, fires in residential areas cause significant property damage. However, many of these incidents may be prevented with the right...

Avoiding Common Home Insurance Claims During Renovations

Thursday, July 25, 2024

Renovating your home can be an exciting journey, transforming your living space into the dream dwelling you've always wanted. However, amidst the excitement, it's crucial to undertake precautions to avoid common...

Did you know your umbrella policy protects both your current and future assets?

Thursday, July 18, 2024

A personal umbrella policy is a liability policy that offers protection over and above your Auto and Homeowner insurance policies. It protects you in instances that result in injury or property damage to someone else...

Hosting a party? Your Friends In The Insurance Business at Ieuter Insurance Group have you COVERED!

Thursday, July 11, 2024

Your Friends In The Insurance Business at Ieuter Insurance Group recently partnered with Dial Tent in Saginaw to create this awesome 20x30 tent so you can celebrate rain or shine! Call us today to find out how your...

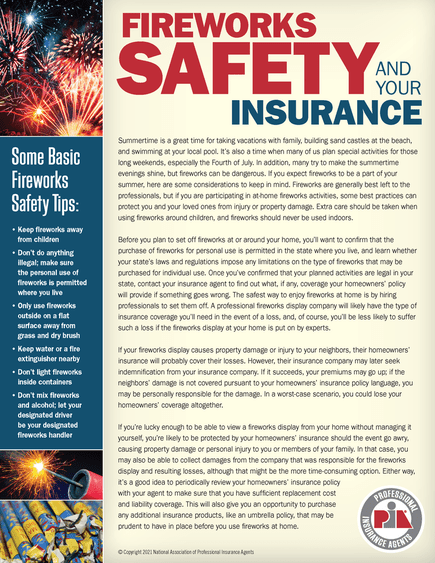

Firework safety and your homeowners insurance policy

Thursday, July 4, 2024

Your Friends In The Insurance Business at Ieuter Insurance Group and our friends at the National Association of Professional Insurance Agents (PIA) wish you a happy and safe Fourth of July holiday. For all your...

What you need to know about Host Liquor liability coverage

Thursday, June 27, 2024

We all love a good event -- an office holiday party, our favorite non-profit fundraising event, a backyard bash on the Fourth of July, or our Best Friend’s magical wedding. It is important to ensure that these nights...

Stop by our office for a free American flag in honor of Flag Day

Thursday, June 13, 2024

Your Friends In The Insurance Business at Midland Michigan's Ieuter Insurance group are honoring Flag Day, which is Friday, June 14, by distributing free American flags. This is the ninth consecutive year that we've...

Homeowners Actual Cash Value (ACV) vs Replacement Cost: A Comparison

Thursday, May 30, 2024

Most people don’t know the difference between Actual Cash Value vs. Replacement Cost. So what is the difference?Actual Cash Value Home Insurance - Actual Cash Value (ACV) will replace your damaged or stolen items, minus...

Does my organization need a directors and officers liability policy?

Thursday, May 23, 2024

Many organizations have a board of directors and a staff of officers. Directors may be owners, employees, or someone outside of the organization serving in an advisory capacity. Officers are typically selected by the...

What Is Hired and Non-Owned Auto Liability (HNOA) Coverage, and Do I Need It?

Thursday, May 16, 2024

What is Hired and Non-Owned Auto Coverage? Hired and non-owned auto liability (HNOA) is a type of insurance coverage that provides protection for businesses and individuals in situations where they use vehicles that...

Tips for towing a boat trailer to reduce accidents and insurance claims

Thursday, May 9, 2024

Owning a boat can make weekends and vacations fun and memorable. Follow these tips to help ensure that when you’re towing your boat you’re being as safe as possible to lower the risk of accidents and unwanted insurance...

Should you consider life insurance for a stay-at-home parent in your household?

Thursday, May 2, 2024

Many people wouldn’t think you’d need life insurance for a stay-at-home parent because they don’t generate any outside income. Income isn't the only factor to consider, however. A stay-at-home parent is responsible for...

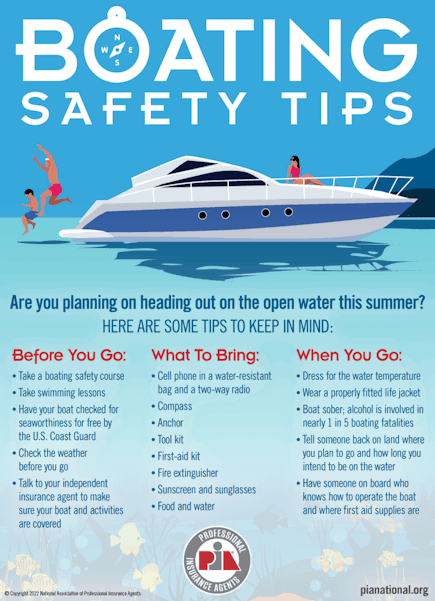

Getting ready for boating season? Don't forget these safety tips and to ensure your boat is insured before you hit the water

Thursday, April 25, 2024

Are you planning on heading out on the open water this summer? Here are some tips to keep in mind: Before you go: Take a boating safety course, have young swimmers take swimming lessons, have your boat checked for...

Ieuter Insurance Group welcomed into Hastings Mutual Insurance Company's 1885 Club for 2024

Thursday, April 18, 2024

Hastings Mutual Insurance Company, an award-winning regional property casualty insurer serving six Midwest states, recently congratulated Ieuter Insurance Group on earning membership into The 1885 Club for 2024. Of the...

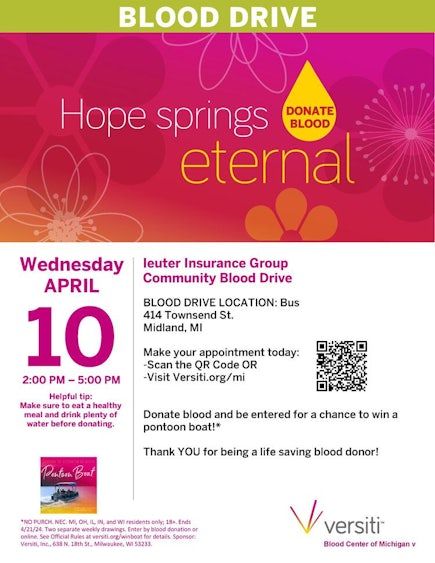

Donate blood and make a difference with us on April 10

Thursday, April 4, 2024

Your Friends In The Insurance Business at Ieuter Insurance Group hope you'll join us in making a difference at our next blood drive, April 10 from 2 - 5 pm at the mobile blood donation center in our parking lot. Giving...

The essential guide to creating a home inventory: Why and How

Thursday, March 28, 2024

In the aftermath of an unexpected event, such as a fire, theft, or natural disaster, having a comprehensive home inventory can be a lifeline. This detailed list of your possessions not only aids in the homeowner...

March 2024 Ieuter Insurance Group Newsletter

Thursday, March 21, 2024

Read our March 2024 newsletter here: newsletter-march-2024.pdf

Paperless billing saves money and time for Ieuter Insurance Group customers who choose Auto-Owners Insurance as their carrier

Thursday, March 14, 2024

Want to have your bills and policy documents emailed to you to cut down on your mail? Have to update where your payments are being pulled from? Need to check on your coverages? For our customers who have Auto-Owners...

I own an LLC – Do I need a workers compensation policy?

Thursday, March 7, 2024

A Workers Compensation policy covers the medical care for workplace injuries and illnesses. It also provides lost wages for employees who are injured on the job. If your LLC has even just one employee, you are required...

My basement is finished – What coverage do I need?

Thursday, February 29, 2024

Having a finished basement comes with it’s share of concerns on whether you’re protected from unforeseen circumstances. We highly recommend Water Backup, also referred to as Sewer Backup, coverage. What does Water...

How to use Ieuter 24/7

Thursday, February 22, 2024

Have you heard of the Ieuter 24/7 feature? It is a website and most importantly an app that can be downloaded on your mobile device. The app allows you to access your proof of insurance and your policy documents, and...

How to choose the right contractor for home improvement projects and avoid liability claims

Thursday, February 15, 2024

If you’re planning a home improvement project, you probably have many contractors available to choose from. How do you pick the right one that will get the job done safely and without liability issues? Follow these tips....

Renting vs. Owning a Home: Protect Your Property No Matter Which You Prefer

Thursday, February 8, 2024

If you’re on the fence about renting or owning a home, here’s a helpful look at the upsides of each option. Remember to get the right insurance when you make your choice, so your property is fully protected. The...

My Windshield is Cracked – What Do I Do?

Thursday, February 1, 2024

Cracked windshields can happen anytime, anywhere. There are many scenarios where you may discover a chip or crack in your windshield. One of the most common incidents that our insureds have is they are driving behind or...

It's a great time to get an auto insurance proposal from Ieuter Insurance Group

Thursday, January 25, 2024

Auto insurance rates are on the rise again, as claim frequency and claim severity have both increased steadily in the past few years. With the 10 largest companies reporting double-digit increases in 2023 as reported in...

I am a sole proprietor ... Do I need workers compensation insurance coverage?

Thursday, January 18, 2024

Most sole proprietors are a one-person team and the owner of the business is not considered an employee. However, this is not always the case and sometimes there is a small crew. A sole proprietor is not required by the...

What is Medicare Supplement Insurance (Medigap), and is it right for me?

Thursday, January 11, 2024

Original Medicare doesn’t pay for all the cost for covered health care services and supplies. Medicare Supplement Insurance (Medigap) policies sold by private insurance companies can help pay some of the remaining...

Top Home Improvement Projects That Can Increase Your Home Value

Thursday, January 4, 2024

When you tackle home improvement projects, it’s wise to prioritize those that add the most to your property’s value, especially if you might put your home on the market in the next few years. Here are the renovations...

Driving safely in the winter

Thursday, December 28, 2023

As of last week, it's officially winter, although we in Michigan often experience wintery weather way before the winter equinox. If you're traveling this winter, we encourage you to take the following precautions to...

Christmas tree safety tips

Thursday, December 21, 2023

It’s the most wonderful time of the year! While Christmas tree fires have been on the decline since the 80’s, they are still common, and the sad reality is one of every 32 Christmas tree fires results in a death. Here...

How to prevent frozen pipes

Wednesday, December 13, 2023

Frozen pipes are no fun to come home to or wake up to. There are several reasons pipes freeze, ranging from lack of insulation to quick drops in temperature, from the temperature being set to low to the wind blowing on...

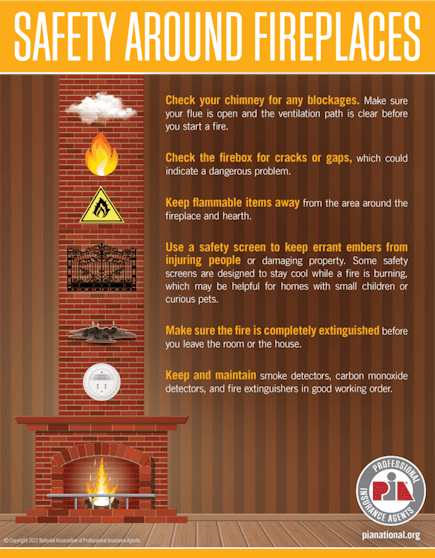

Stay safe from fire hazards this holiday season

Thursday, December 7, 2023

Follow these tips to keep your household safe from fire hazards this holiday season: 1. Make sure the fire in the fireplace is completely out before going to sleep. 2. Keep flammable items at least three feet from your...

Portable generator safety tips

Thursday, November 30, 2023

As we enter the time of the year where Michigan's weather becomes more unpredictable, you might be thinking about getting a generator. When power goes out a portable generator can be a lifesaver, and when used properly...

Is it safe to deep fry your Thanksgiving turkey?

Thursday, November 23, 2023

Will you be deep frying a turkey this Thanksgiving? Be sure to read the manufacturer's instructions carefully, and consider traditional oven-style turkey preparation if you can't ensure you'll be able to prepare your...

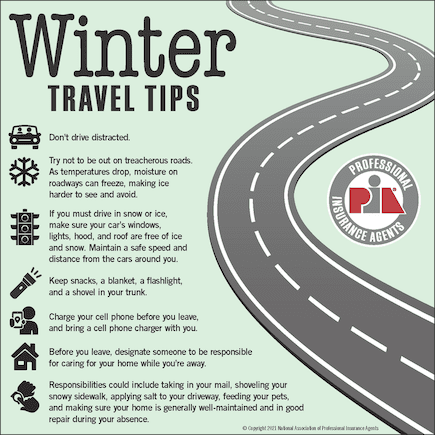

Preparing your auto and your home for winter travel

Thursday, November 16, 2023

Have plans to travel for the upcoming holidays? Safe travel in the winter certainly involves planning ahead. Here's some tips from our friends at the National Association of Professional Insurance Agents. (Did you know...

Tips for driving safely at nighttime

Thursday, November 9, 2023

Nighttime driving can be riskier at any age but seems to have the most impact on the elderly and young, inexperienced drivers. However, there are things you can do to keep your nighttime driving as safe as possible. As...

Hired and non-owned auto coverage

Thursday, November 2, 2023

If an employee drives their personal vehicle for business purposes, as the owner of the company, am I responsible for damages from a potential car accident? The answer to this question is yes! If an employee is driving...

Have a safe Halloween with these tips from Ieuter Insurance and PIA!

Thursday, October 26, 2023

Are you ready for ghosts and goblins that could visit YOUR home on Halloween? Have a safe Halloween with these tips:*Encourage the use of makeup, hats, or wigs in lieu of masks, which can obstruct vision. *Cross the...

Steps to take when there's water in your basement

Thursday, October 19, 2023

Walking down to your basement to find that water has filled your home is a horrible feeling and a major headache. Please don’t delay fixing the problem as mold can start to grow in 24-48 hours. If it is clean water,...

As open enrollment periods approach, consider the benefits of an HSA

Thursday, October 12, 2023

As open enrollment periods approach, you may be considering the benefits of an HSA.Paying for healthcare expenses can be very stressful, but there are options to assist in covering those unexpected bills. A Health...

What is cyber insurance, and why might I need it?

Thursday, October 5, 2023

Every year since 2003, October has been recognized as Cyber Security Awareness Month (CSAM). This effort was brought to life through a collaboration between the U.S. Department of Homeland Security and the National...

Umbrella coverage benefits are wide ranging

Thursday, September 28, 2023

Executive umbrella policies provide additional liability limits in addition to your personal auto, homeowners and watercraft policies. What will happen to your assets if you’re involved in an automobile accident, and...

If you get in an auto accident, what should you do?

Thursday, September 21, 2023

If you get in an auto accident, what should you do? If anyone is injured, call 911. Move to a safe area. Get a police report, especially if the other party is at fault.Take pictures of damage, license plate, other...

Installation floater coverage for building contractors' commercial insurance policies

Thursday, September 14, 2023

Today, we'll discuss what an installation floater is for building contractors and what it covers on your commercial insurance policy. An installation floater is part of your Inland Marine coverage but different than the...

What is an annuity and how can it benefit me?

Thursday, September 7, 2023

An annuity is essentially a contract between you and an insurance company in which you deposit a sum of money, and interest accrues on that deposit. With our ever-changing economy, annuity policies with Auto-Owners are...

Standard vs Broad Form Auto Insurance Coverage in Michigan

Thursday, August 31, 2023

Imagine the following scenario: Stella was traveling east down the street. Another vehicle was travelling north and ran the stop sign. Stella’s car was hit. The police were contacted and the other driver was cited for...

Short-Term and Long-Term Disability Insurance. Is it worth it?

Thursday, August 24, 2023

Disability Insurance, also known as Disability Income Insurance, pays you a portion of your wages in the event you are unable to work due to a serious illness, medical condition or injury. It is typically offered by...

Are your Volunteers Covered?

Thursday, August 17, 2023

Many kinds of businesses use volunteers on a regular basis, and it is typically a mutually beneficial relationship. But what happens if one of your volunteers gets hurt? Who pays their medical bills? The common...

Do you have a child heading to college this fall? Talk to your agent about coverage changes

Thursday, August 10, 2023

It's a busy time of year for parents preparing to send their children off to college. Your Friends In The Insurance Business at Ieuter Insurance Group recommend checking in with your agent before they depart to ensure...

Defensive Driving Techniques to Avoid Accidents and Insurance Claims

Thursday, August 3, 2023

If you want to reduce your risk of traffic accidents and the insurance claims that accompany them - which could cause your premium to go up - you need to drive defensively. Here are some driving tips to help you avoid...

What to Look for When Buying a House to Avoid Unnecessary Insurance Claims

Thursday, July 27, 2023

If you’re house hunting, you’re probably looking at many elements like the number of bedrooms or how updated the kitchen is. Don’t forget to check for these things too, which which may help avoid home insurance claims...

Ieuter Insurance Group's Steve Scott's Wish-A-Mile Ride

Thursday, July 13, 2023

For the Scott family, making a difference is a family affair. Steve Scott embarked on his first Wish-A-Mile Bicycle Tour last year, training much of the year for the rigorous 300-mile, three-day cycling circuit from...

Beat the heat with a free Bay City Boat Lines tour compliments of Ieuter Insurance Group and Auto-Owners Insurance

Thursday, July 6, 2023

Looking for a great way to beat the heat and explore the Great Lakes Bay region? Register for a History Tour on Bay City Boat Lines' Princess Wenonah next week (July 10-13), courtesy of Your Friends In The Insurance...

New Michigan Distracted Driving Law Goes into Effect June 30

Thursday, June 29, 2023

Michigan drivers take note: Under the a new law that takes effect on June 30, drivers will be barred from using social media, watching or recording videos or holding their phones to make a call while driving in addition...

4 Water-Saving Tips for Your Garden

Thursday, June 22, 2023

Water has been in short supply in many areas of the United States lately. And even if it’s bountiful where you live, you may be paying more for water than you’d like. Here are some tips for using less water and saving...

State of Michigan charging new Personal Injury Protection (PIP) fee for all vehicles beginning July 1

Thursday, June 15, 2023

Remember the auto refund Michigan drivers received from the State of Michigan last year? Now the MCCA fund (State of Michigan fund to pay for medical claims) is at a deficit in part because of all the money the...

Boating Safety Tips

Thursday, June 8, 2023

Are you planning on heading out on the open water this summer? Putting your boat in the water for the first time this year? Don't forget to reach out to Your Friends In The Insurance Business to make sure your coverage...

Keep Your Home Safe While on Vacation

Thursday, June 1, 2023

Whether you’re just getting away for a long weekend or spending a few weeks out of the house, it’s important to ensure your home is safe while you’re gone. Follow these tips to help prevent break-ins, fires, and water...

Boating Season is Here – Are You Up to Speed on Safety?

Thursday, May 25, 2023

With spring in full bloom and summer just on the horizon, prime boating season is upon us. And you might notice more people on the water than ever, because sales of recreational boats have been growing at a steady clip,...

Donate Blood With Your Friends In The Insurance Business on May 23!

Thursday, May 18, 2023

Did you know it takes less than 15 minutes to save a life (or lives) as a blood donor? Donation times typically run between 8 and 10 minutes and make such a crucial impact on community health. Sign up for your preferred...

Is Pet Insurance right for you?

Thursday, May 11, 2023

When our furry friends are sick we sometimes have to make that urgent decision at the vet’s office on how much we can afford to spend. In 2020 Americans spent more than $31.4 billion on veterinary care. Pet insurance...

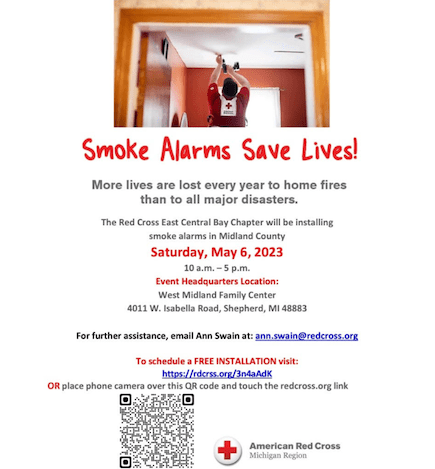

Smoke detector installation day is Saturday, May 6!

Thursday, May 4, 2023

Did you know that more lives are lost every year to home fires than all other major disasters? Your Friends In The Insurance Business at Ieuter Insurance Group in Midland, MI. know how important it is to have properly...

The Importance of Uninsured and Underinsured Motorist Coverage

Thursday, April 27, 2023

Your auto insurance is one of the most important elements of your personal insurance portfolio. But some people purchase only the minimum required liability coverage, not realizing they may be leaving themselves open to...

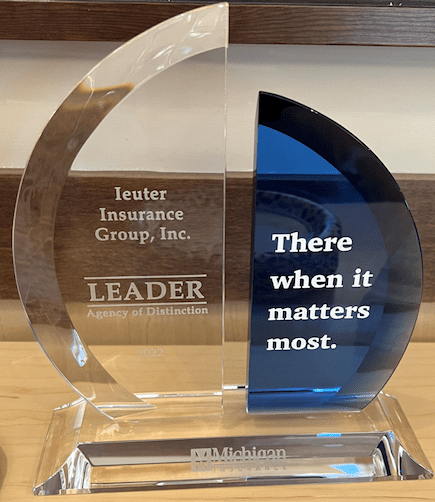

Ieuter Insurance Group earns Leaders' Level Award of Distinction from Michigan Insurance Company

Thursday, April 20, 2023

Thank you to Shawn Gregg at at Michigan Insurance Company (a Donegal Insurance Group Company) for visiting the team at Ieuter Insurance Group to personally present this Agency of Distinction Award for reaching the...

Congratulations Kurt and Dawn for earning the President's Club Award from Auto-Owners Insurance once again!

Thursday, April 13, 2023

Thanks to the Midland Daily News for this coverage of our own Kurt O. Ieuter earning a spot on Auto-Owners Insurance's President's Club for the 23rd time in 2022. https://www.ourmidland.com/news/article/kurt-ieuter-...

Don't neglect life insurance for the stay-at-home parent in your household

Thursday, April 6, 2023

Why does a stay-at-home parent need life insurance? This is a question that we frequently get asked when discussing life insurance policies with our clients. Many people think of the income that a working parent brings...

Why choosing an Independent Insurance Agent matters so much

Thursday, March 30, 2023

Buying insurance can be confusing. Price is important, but so is getting coverage that fits your needs. You want good value for your money, whether you’re buying protection for your home, your car, or your business.The...

Avoiding slip and fall accidents in the workplace

Thursday, March 23, 2023

Every year there are reported cases of ER visits for around 8 million people slipping and falling at a place of business, according to the National Floor Safety Institute.Slip-and-fall accidents aren't the #1 cause of...

Do You Need a Friend in the Insurance Business?

Thursday, March 16, 2023

Your Friends In The Insurance Business at Ieuter Insurance Group were delighted to provide job shadowing this week for the participants in Northwood University's Insurance Leadership Academy for high school juniors and...

When you spring forward this weekend, be sure to replace your smoke detector batteries, too!

Thursday, March 9, 2023

In Michigan, we spring forward this Sunday, so don't forget to reset any clocks that don't automatically update including your microwave, older automobiles and more.While you're at it, we recommend switching out your...

Do you need disability coverage?

Thursday, February 23, 2023

Do you own a business? Are you a sole proprietor? Are you excluded from workers compensation? What happens if you get hurt at work and you do not have workers compensation coverage? Do you have enough money saved up to...

Professional Liability Insurance: What Is It and Who Needs It?

Thursday, February 16, 2023

Professional Liability is a type of business insurance policy that provides coverage for businesses and professionals to protect against claims for negligence or errors and omissions. Individuals with an area of...

Are you inviting friends over for the big game? Keep these party safety tips in mind!🥳

Thursday, February 9, 2023

Not sure if you're covered for all the unexpected hazards that throwing a party might entail? Be sure to discuss your coverage needs with Your Friends In The Insurance Business at Ieuter Insurance Group. We've got all...

Ieuter 24/7 app

Thursday, February 2, 2023

Ever forget to put your Proof of Insurance in your vehicle? Need to submit a change after hours? Need to send a Certificate of Insurance? With our Ieuter 24/7 app, you can do all of this and more! This great app will...

Who Needs Life Insurance and How Much Do You Need?

Thursday, January 26, 2023

It’s an unfortunate fact that life expectancy in the US has dropped recently. This has led many people to examine whether or not they should have a life insurance policy and, if so, how much coverage they should have....

Family Emergency Preparedness Checklist

Thursday, January 19, 2023

It seems like every day on the news that we hear stories about a hurricane, flood, or wildfire creating massive damage in the U.S. and putting people out of their homes. Have you thought about how your family would...

Join Your Friends In The Insurance Business Jan. 19 to Give Blood and Save Lives for National Blood Donor Month!

Thursday, January 12, 2023

Did you know that January is National Blood Donor Month?It only takes 15 minutes to save a life, and we've expanded our hours for our January drive to make it easier to donate after work!Sign up for your preferred...

After the holidays, it's a great time to update (or start) your Home Inventory List

Thursday, January 5, 2023

Did you resolve to be more organized this year? One of the most important ways to do this and to make sure you're covered in an emergency is to update your Home Inventory list. There are some great apps that can help...

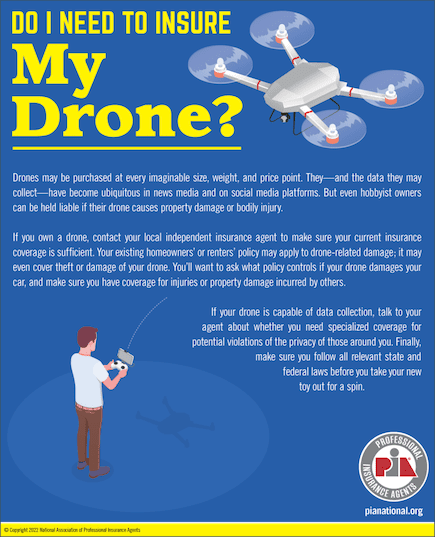

Have questions about drone insurance coverage?

Thursday, December 29, 2022

Did you give (or get) a drone for a holiday gift this year? Read this helpful info from our partners at the National Association of Professional Insurance Agents to answer all your drone safety and drone coverage...

As you wrap up your holiday shopping, don't forget to insure your large purchases, and swing by Ieuter for a free sweatshirt!

Thursday, December 22, 2022

As you finish purchasing the last gift items on our Christmas lists you may want to review your insurance coverage. Are you purchasing an Ipad for your teenager or a diamond necklace for your partner? If so, you may...

Preparing for winter travel

Thursday, December 15, 2022

Have plans to travel for the upcoming holidays? Safe travel in the winter certainly involves planning ahead. Here's some tips from our friends at the National Association of Professional Insurance Agents. (Did you know...

What to Check Before Buying a Used Car

Wednesday, December 7, 2022

With the new car market impacted by shipping delays, many people are choosing to buy used cars lately. And some people only purchase a used vehicle because it saves them money and lets the first owner figure out if it’s...

Practice caution when considering deep frying your Thanksgiving turkey

Thursday, November 24, 2022

Will you be deep frying a turkey this Thanksgiving? Be sure to read the manufacturer's instructions carefully, and consider traditional oven-style turkey preparation if you can't ensure you'll be able to prepare your...

Did you know modern homes aren't as fire-resistant as those of yesteryear?

Thursday, November 17, 2022

From building materials to furnishings, many of the things in your home likely aren’t as flame-resistant as those from yesteryear. A fire in a modern home is a “perfect storm,” according to safety consulting and...

Should I Notify My Insurance Company About a New Puppy?

Thursday, November 10, 2022

Having a new puppy join your household can change your life. The snuggles and kisses make getting up in the middle of the night for potty breaks worth it, but in the whirlwind of change, it’s easy to forget some...

Is your car stocked with winter and year-round necessities?

Thursday, November 3, 2022

As we start running the risk of snow, it's a great time to double-check that your car is stocked with all the necessities. Here's a great list to get you started: 1. Flashlight (with spare batteries) – Because sometimes...

There's a deer in your headlights ... how do you respond?

Thursday, October 27, 2022

Deer are everywhere, and with shorter days come more dark hours where it can be tough to avoid them! Many people ask, “What should I do when they jump out in front of me”? Most of the time you can see deer on the side...

Safety Around Fireplaces

Thursday, October 20, 2022

As chilly fall evenings are finally upon us, Your Friends In The Insurance Business at Ieuter Insurance Group are thinking about fireplace safety. Here's some safety tips from our friends at the National Association of...

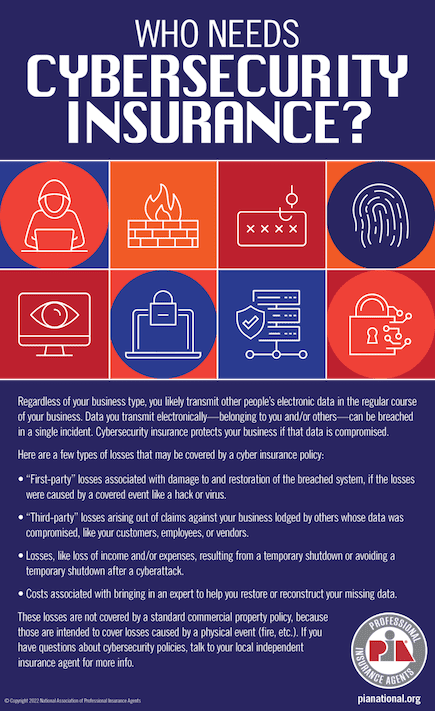

Who Needs Cybersecurity Insurance?

Thursday, October 13, 2022

For all your insurance needs, visit us at https://www.ieuter.com Ieuter Insurance Group - 414 Townsend St Midland MI 48640 (989) 487-1758 Social accounts: https://www.facebook.com/ieuterinsurancegroup/ https://twitter....

How to Choose the Right Smart Security Camera

Thursday, October 6, 2022

A security camera can help protect your property against intruders or provide evidence in the event of a break-in. But with all the technology available today, it can be tough to figure out which smart security camera...

Pick up your free pumpkin at Ieuter Insurance Group while supplies last!

Thursday, September 29, 2022

It's the Great Pumpkin Charlie Brown! 🎃 Wait ... that's not Charlie Brown, it's our own President Cal Ieuter! It's that time of year for the Great Pumpkin Giveaway brought to you by Your Friends In The Insurance...

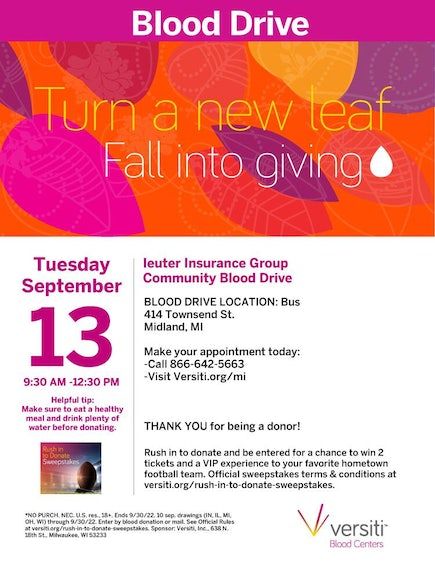

Give Blood and Save Lives With Your Friends In The Insurance Business on Sept. 13!

Thursday, September 8, 2022

Your Friends In The Insurance Business at Ieuter Insurance Group are proud to be once again partnering with Versiti Blood Center of Michigan for a blood drive on September 13. We asked a few members of the five-gallon...

Things to Know When Shopping for Home and Auto Insurance

Saturday, September 3, 2022

It’s Back-to-School Time — Is Your House Ready?

Thursday, August 25, 2022

We’re not quite sure where summer went, but if you haven’t noticed, the new school year is upon us. And as you get your kids organized and ready, consider doing the same thing for something else - your home. It won’t...

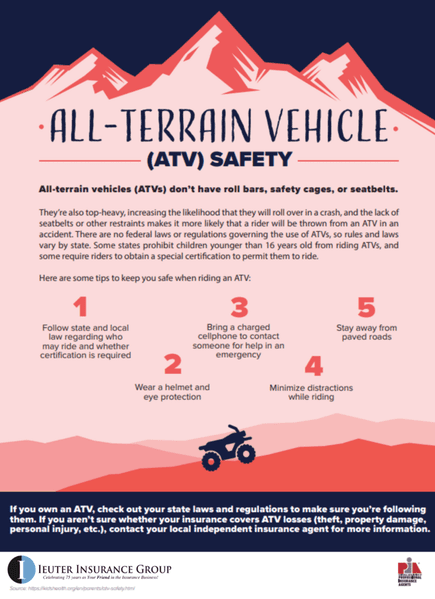

Enjoy free ORV weekend safely with these ATV safety tips

Thursday, August 18, 2022

Both Michigan residents and out-of-state visitors can enjoy DNR-designated routes and trails without purchasing an ORV license or trail permit this weekend (August 20-21, 2022). Here's some tips to enjoy free-ATV...

Grill Safely With These Outdoor Cooking Tips

Thursday, August 11, 2022

Grilling food is a fun pastime, and it’s ideal on those summer days when you don’t want to heat up the kitchen. But every year, there are accidents and home fires because people don’t grill safely. Follow these tips to...

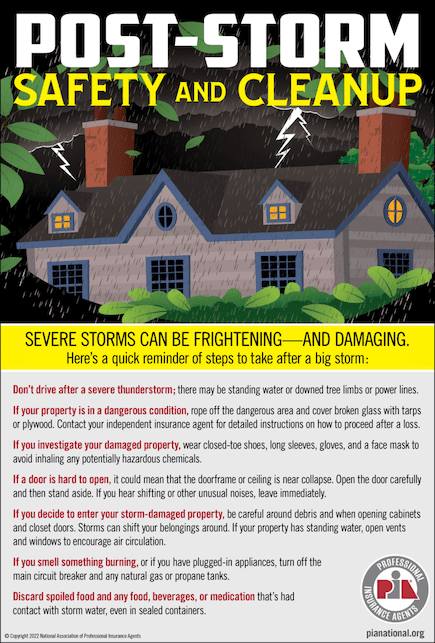

Post-storm safety and cleanup

Thursday, August 4, 2022

Much of our region saw some serious storms come through in the last 24 hours.Severe storms can be frightening-and damaging. Here’s a quick reminder of steps to take after a big storm: Don’t drive after a severe...

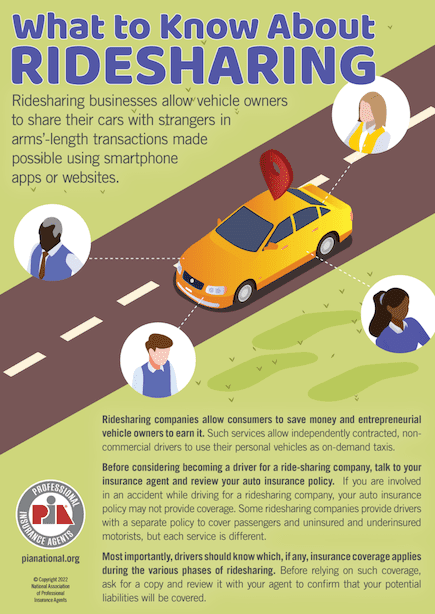

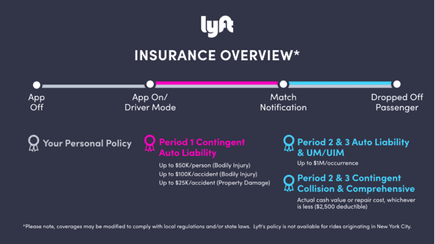

Ride=sharing services present risks for drivers

Thursday, July 28, 2022

You may have received an email from Your Friends In The Insurance Business at Ieuter Insurance Group warning you about the risks involved with ride-sharing apps, both for drivers and for passengers. If you have any...

Simple Household Pest Control Methods

Thursday, July 21, 2022

No one likes the thought of having pests in their home, whether they be rodents, cockroaches, ants, or any other common household pests. If pest activity is common in your area, it is important to take steps to prevent...

Medicare fraud: How to recognize it and prevent it?

Thursday, July 14, 2022

Medicare scams are something that often happen to the unsuspecting, and these scammers primarily target the elderly. Scammers will contact you through various means: phone calls, mail, fax, and even door-to-door. The...

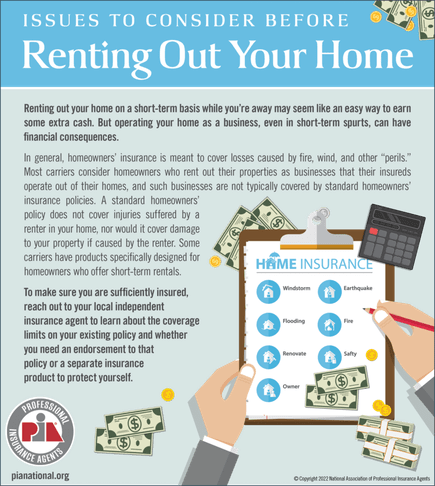

Issues and Insurance Coverage to Consider Before Renting Out Your Home

Thursday, July 7, 2022

Issues to Consider Before Renting Out Your Home Renting out your home on a short-term basis while you’re away may seem like an easy way to earn some extra cash. But operating your home as a business, even in short-term...

Landscape Maintenance Tips for Your Yard

Thursday, June 23, 2022

You've worked hard to create a beautiful garden for your yard, but there is more to yard maintenance than simply mowing the lawn and watering the plants. There are plenty of other tasks you'll need to complete in order...

Summer heat & fire risks

Thursday, June 16, 2022

For all your insurance needs, visit us at https://www.ieuter.com Ieuter Insurance Group - 414 Townsend St Midland MI 48640 (989) 487-1758 Social accounts: https://www.facebook.com/ieuterinsurancegroup/ https://twitter....

All-terrain vehicle safety

Thursday, June 9, 2022

It's"three free" weekend June 11-12, when the free off-road-vehicle (ORV) weekend lines up with Summer Free Fishing Weekend, when fishing licenses and the Recreation Passport requirement are waived at Michigan State...

How to Make Your Family Vacation a Great One

Thursday, June 2, 2022

Summer is here, which means it’s time to think about family vacations! (If you haven’t been thinking about them all year, that is.) Or perhaps a friend-cation like the one several Midlanders pictured above took recently...

How to Ride Your Motorcycle Safely in a Group

Thursday, May 26, 2022

Group riding is a favorite activity among many motorcycle riders. Whether you’re part of a riding club, a social event, a charity ride, or out for a leisurely cruise with friends, group riding can be a rewarding way to...

Avoiding Water Issues in Your Home

Thursday, May 12, 2022

Water damage is one of the worst problems that homeowners can run into. Not only can it be incredibly expensive to repair, depending on the extent of the damage, but it can also create the potential for mold and mildew...

Make a difference with us! Donate blood on May 9

Thursday, May 5, 2022

Are you a digitally savvy donor? Donate blood at Ieuter Insurance Group's May 9 Versiti Blood Center of Michigan blood drive and you will be entered into the Donate for Downloads Sweepstakes for a chance to win a $75 e-...

Keep Your Pets Safe in a Disaster

Thursday, April 28, 2022

A safe home, a regular routine, a soft bed – the things that bring you comfort bring your pet comfort, too. It’s so important to give some advance thought to how you’d handle your pet responsibilities during and after a...

Three Ways to Lower Your Carbon Footprint

Thursday, April 21, 2022

April 22 marks the 52nd annual Earth Day, when more than 1 billion people in nearly 200 countries are expected to take part in what the Earth Day Network calls “the largest civic-focused day of action in the world.”...

What Car Drivers Need to Know about Motorcycles

Thursday, April 14, 2022

Spring is here, and we're starting to see more and more motorcycles on the roads. And the key word here is “see.” People driving cars and trucks often fail to notice the motorcyclists around them, partly because they’re...

Commonly Overlooked Spring Cleaning Tasks

Thursday, April 7, 2022

Spring is a common time for people to take on all of the cleaning tasks that they put off during the winter. With the weather getting warmer, it's the perfect time to tackle jobs both inside and outside your home. While...

What to Consider When Choosing Auto Insurance

Thursday, March 31, 2022

Carrying a minimum amount of auto insurance is required by state laws, so you can’t legally drive without it. Yet while the minimum amount keeps your premiums lower, it can also put you at great risk if you have an...

Spring Cleaning Tips

Thursday, March 24, 2022

Spring is a time for new beginnings, and cleaning and organization around the house are very popular this time of year. If you’re ready to tackle the monumental spring cleaning chore, read on for some helpful...

Upgrading Your Windows - How to Choose What's Best for Your House

Thursday, March 17, 2022

You may not give the windows on your home much thought, but they can actually make a big difference not just in your comfort level, but also in the value of your home. You'll have a wide range of options to choose from,...

What is general liability insurance for?

Thursday, March 10, 2022

General liability insurance is crucial if you have a business to protect. If a third party gets hurt and has bodily injury, incurs property damage, or claims to have been damaged by an advertisement that was posted (...

Why You Need Service Line Coverage

Thursday, March 3, 2022

Let’s spare a moment for something most of us use every day yet probably take for granted: our service lines. We rely on them for access to water, electricity, gas, Internet connection, and more, but only think about...

Should I Buy Rental Car Insurance?

Thursday, February 24, 2022

Most personal auto insurance policies cover you for rented vehicles, and they will cover you for the same coverages you have on your personal auto policy. Before renting a car, check first with your agent to see if your...

Does your nonprofit organization need a non-owned auto insurance policy?

Thursday, February 17, 2022

Do you have employees and/or volunteers using their personal vehicles on behalf of your organization for activities such as running errands, performing services, or transporting clients on behalf of your organization?...

I Just Bought a New Car. What Insurance Coverage Do I Need?

Thursday, February 10, 2022

Congratulations! After weeks of research, comparing makes and models, and taking test drives you finally bought that brand-new car you wanted. But before you take that well-deserved road trip, check one more item off...

Tips for Saving Money on Heating and Cooling Your Home

Thursday, February 3, 2022

If you're like most people, you like to keep your home at a comfortable temperature throughout the year. However, running your heater or air conditioner constantly uses a lot of energy, and your electric and gas bills...

How to Evaluate and Choose Energy-Efficient Appliances

Thursday, January 27, 2022

Today's modern appliances are much more energy-efficient than their predecessors, and some are even better than the rest. When shopping for appliances, you'll likely be overwhelmed by choice, so it is important to know...

Does my Blue Cross Blue Shield coverage include at-home Covid-19 tests?

Thursday, January 20, 2022

Your Friends In The Insurance Business at Ieuter Insurance groups have been fielding a few calls from clients with questions about Blue Cross Network's coverage of in-home Covid-19 tests. As of Jan.15, 2022, all...

Michigan Auto Insurance Refund Frequently Asked Questions Answered

Thursday, January 13, 2022

Do you have questions about the refund of $400 per insured vehicle that Michigan policyholders are expected to receive by May 9, 2022? Visit the DIFS website for answers to frequently asked questions, including whether...

When Roadside Assistance Isn’t Enough

Thursday, January 6, 2022

If you’ve ever been stuck on the side of the highway with an RV issue, you know what a life saver roadside assistance can be. Whether you need a battery charged, a tire changed, or a tow you’re often back on the road in...

How to Protect Your Classic Car

Thursday, December 23, 2021

The collector car market evolves with each generation. While the Silent Generation started collecting cars, it was Baby Boomers who really got it rolling. They fell in love with the Chevrolet Bel Air, the Ford Mustang,...

What is water backup coverage and why is it important?

Thursday, December 16, 2021

Water damage can be disastrous to your home. Imagine discovering that your entire basement is filled with brown water and sewage from a backed-up water main or other pipe. It’s not only disgusting and potentially...

How to Choose Smoke and Carbon Monoxide Detectors

Wednesday, December 15, 2021

Smoke and carbon monoxide detectors are essential for any home, so you should ensure that your house is equipped with them. You should have detectors in the main living areas on each floor, including in every bedroom...

Do you need insurance for your E-bike

Thursday, December 9, 2021

E-Bikes are a popular holiday gift this year, which leads to questions about whether you have to do anything special when it comes to insuring them. The answer is: YES! Call Your Friends In The Insurance Business any...

How to Make a Fire Safety Plan

Thursday, December 2, 2021

No one likes to think about the possibility of a fire in their home, but this is one situation where it definitely pays to be prepared. This is especially true if you have children or pets in your home. Read on to learn...

Please VOTE to help Ieuter Insurance Group secure $10,000 for Camp Fish Tales

Thursday, November 11, 2021

Camp Fish Tales provides a place for individuals with special needs to experience the outdoors, connect with peers and develop skills that enhance their quality of life. To cast your vote, visit our Make More Happen...

Don’t Delay — Start Thinking About Winterizing Your RV Today

Thursday, November 4, 2021

Unless you’re headed to a warmer climate for the winter - or you live in one already - fall is the time to start preparing your RV for winter (as long as you’re done using it for a while, that is). And just because you...

How Independent Agents Are Different from Captive Agents

Thursday, October 28, 2021

When it comes to buying insurance, you have two primary options available to you: independent agents like us, and captive agents. While both can provide insurance services, these two types of insurance agents are not...

How to Decide If Solar Panels Are Right for Your Home

Thursday, October 21, 2021

Solar panels can provide clean electricity for your home, helping you to save money on energy costs while also doing your part to help the environment. However, not all homes are suited to solar energy. Here's what you...

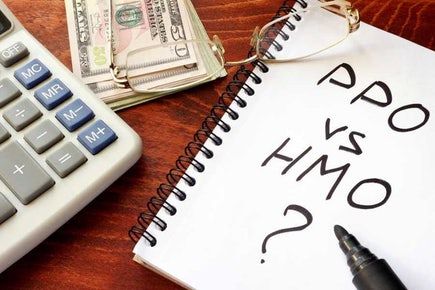

Know Your Health Insurance Provider Networks

Thursday, October 14, 2021

Health insurance plans generally utilize one of three provider network designs: PPO, HMO or POS. Knowing which one your plan uses helps you understand the extent of coverage your health insurance provides and plan for...

Tips on Reducing the Cost of Homeowners Insurance

Thursday, October 7, 2021

Your home provides security, joy, privacy and shuts out the noise of the world. Whether your home is big or small, it’s still your sanctuary. Buying homeowners insurance is the best way to safeguard your greatest asset....

Home Security Technology: Keeping you ahead of the burglars

Thursday, September 30, 2021

Back in the early days of home security “systems,” around the end of World War I, it was common for homeowners to hire “door shakers”-night watchmen who would literally walk around and check doors to make sure they were...

10 Things to do to Prepare Your Home for Fall

Thursday, September 23, 2021

Fall is a wonderful time - if your home is ready for it. So enjoy the last few weeks of warmer weather, but do a little preventative maintenance while you’re at it. You’ll fix small problems before they become big, and...

Pet Insurance

Thursday, September 16, 2021

Did you know Your Friends In The Insurance Business can help you insure your four-legged family members, too? Take comfort in knowing that we offer pet insurance for your fur babies. When you utilize pet insurance, you...

College students renting apartments/homes need renters insurance

Thursday, September 9, 2021

When you sent your student away to college this fall, did you remember to pack renters insurance? Yes, kids away at college and renting homes or apartments need renters insurance. Renters insurance is the easiest and...

Five Tips to (Finally) Get your Garage Organized

Thursday, September 2, 2021

There’s perhaps no organizing task more daunting than the garage-it’s often the dumping ground for the stuff that has no other place in the house, or the things you don’t use but just can’t bring yourself to toss. How...

Employee theft prevention

Thursday, August 26, 2021

An employee is 15 times more likely than a non-employee to steal from an employer. Employees who steal typically have worked within the business for several years before beginning to steal, and they continue for an...

Benefits of Using a Dash Cam

Wednesday, August 18, 2021

More and more people these days are choosing to add dash cams to their vehicles, and for good reason. These small cameras can be highly useful to you, especially in the event that you get a traffic ticket or are...

Looking at a new piece of jewelry? Make sure to look at your insurance, too

Thursday, July 22, 2021

Whether it’s a gift from someone special or a gift to yourself, a new piece of jewelry can bring some sparkle to your life. However, many people who find themselves victimized by burglars-or a fire or some other...

Tips for Power Tool Safety

Thursday, July 15, 2021

What would you do without power tools? Well, you’d probably take on fewer home-improvement projects - and probably have a lot more calluses on your hands. Thankfully, you don’t have to do without. But you do have to use...

Swimming Safety: 10 Tips for Summer

Thursday, July 8, 2021

Summer is here and people are flocking to the water - whether it’s the beach, a lake, a river or a backyard pool. But, wherever there’s water, there’s also danger. According to the U.S. Centers for Disease Control and...

Tips for a super (and safe) Fourth of July weekend

Thursday, July 1, 2021

Memorial Day might be the unofficial start of summer, but Independence Day is when the season truly kicks into high gear. July 4 is a holiday that has something for everyone, whether you like to host (or attend)...

Why You Might Want to Live Like a Minimalist

Thursday, June 24, 2021

Decluttering is having a moment these days. Organizing guru Marie Kondo has her own show on Netflix, people everywhere are going through their things and asking, “Does this bring me joy?” and many are even exploring the...

How Many Homes in the US are Underinsured

Thursday, June 17, 2021

What is the meaning of underinsured? - If your property is underinsured, it means that your insurance policy covers only a part of your total assets. Reasons for Underinsured Homes - Reports suggest that there are...

Why You May Need Personal Offense Coverage

Thursday, June 10, 2021

In today’s digital world, slander and libel lawsuits are more common than you may think. Comments made in haste or anger on social media can have lasting and far-reaching effects on a person’s reputation or character,...

Own a home? Here are two policy options you should know about

Thursday, June 3, 2021

Inexpensive Fixes for a Safer Home

Thursday, May 27, 2021

Home improvement: It’s a never-ending process for many people, and for those of us who aren’t necessarily handy, it can be a hassle, too. But there are plenty of simple maintenance tasks and other improvements you can...

Dangers of a Sedentary Lifestyle

Thursday, May 13, 2021

Have you ever heard of Sitting Disease? Most of us working in an office setting (students, commuters, etc.) are sitting too much. The average American sits 11 hours per day, and the cost is high and presents itself in...

Car Shopping and Insurance Quotes

Thursday, May 6, 2021

You are in the process of shopping for a new car (or new-to-you car) and found one you love! The deciding factor for going through with the purchase may be the cost of insurance. Your Friends in the Insurance Business...

Few Questions You Must Ask Before Purchasing Health Insurance

Thursday, April 29, 2021

Health insurance is one of the most critical aspects of securing your future. It is essential to safeguard your family, and you mustn’t take it lightly. Carefully scrutinize the details and see the terms and conditions;...

Why a Basic Homeowners Policy Isn’t Always Enough

Monday, April 26, 2021

Sometimes a basic homeowners insurance policy just isn’t enough. As your career advances and your income increases, it’s important to keep your insurance protection up to date. This helps you avoid expensive gaps in...

10 Tips to Help Prevent Identity Theft

Thursday, April 15, 2021

Shopping online. Visiting the doctor. Buying gas. In nearly all of the things we do from day to day, there’s the risk of identity theft. You could unknowingly give your information to a fraudster thinking you’re...

Can I Get Car Insurance For Mailbox Collisions?

Thursday, April 8, 2021

We all make driving mistakes once in a while. People accidentally ram into mailboxes all the time, and even though you might not get hurt, your car may have sustained insurance-worthy damage. The question at this point...

Term Life Insurance versus Permanent Life Insurance - Pros and Cons

Thursday, March 25, 2021

A lot of financial advisors will stand by the statement: “Buy term and invest the rest.” This statement refers to the fact that term insurance is often 10x less expensive and that the stock market will traditionally...

Home Cyber Protection Coverage -- Why it's important and what it covers:

Thursday, March 18, 2021

Home Cyber Protection is more and more important and cyber crime has been increasingly on the rise and impacts both individuals and businesses alike. Home Cyber Protection provides the following coverages: Cyber Attack -...

4 ways your business can benefit from Equipment Breakdown Coverage

Thursday, March 11, 2021

From computers to cranes, stoves to HVAC systems, your business undoubtedly relies on equipment to run smoothly. However, the mechanical, electrical, and computer equipment your company uses are not invincible....

Do I have coverage for my small or part-time business under my Homeowners Policy?

Thursday, March 4, 2021

In this day and age it is very common for people to have a small business or a hobby that brings in some extra income. Whether you have a full-time job and enjoy earning some extra income with your part-time hobby, or...

How to Update your Home — Without Spending Thousands

Thursday, February 25, 2021

It doesn’t take a massive remodel, or a big budget, to make your house feel a little more like home to you. Inside or out, small improvements can make a significant difference - and whether you’re handy or not, you can...

What is general liability insurance for?

Thursday, February 18, 2021

General liability insurance is crucial if you have a business to protect. If a third party gets hurt and has bodily injury, incurs property damage, or claims to have been damaged by an advertisement that was posted (...

Snowmobile Safety Tips

Thursday, February 11, 2021

We've finally got a good bit of powder on the ground, and snowmobile enthusiasts are ready to jump on the sled and have some fun. To keep yourself safe, there are precautions you need to take to ensure your safety and...

Understanding Why Health Insurance Doesn’t Cover Dental Care

Thursday, January 28, 2021

Several medical insurance coverage plans don’t cover dental care, despite teeth problems having a significant impact on an individual. Several dental treatment plans such as braces and teeth whitening are deemed not...

5 Carbon Monoxide Safety Tips

Thursday, January 28, 2021

Every year, unintentional carbon monoxide (CO) poisoning (not linked to fires) sends 20,000 people to the emergency room and causes more than 4,000 hospitalizations. And, you might consider them the fortunate ones. CO...

I hit a deer! Now what?

Thursday, January 21, 2021

If you've been in an accident involving a deer, take these steps to ensure your safety and that of the animal: Move your vehicle to a safe location. If possible, pull over to the side of the road, and turn on your...

When Does Life Insurance Payout?

Friday, January 15, 2021

Life insurance provides financial stability to your family and your loved ones after you pass away. It is a long term investment and acts as a security blanket for your family. Life insurance is a contract between the...

Porch Safety: Should You Leave the Lights On?

Thursday, January 14, 2021

It seems like a no-brainer to leave the lights on outside your home to deter burglars while you’re away (or even while you’re asleep). But does that really work? Or is it just a waste of electricity — particularly this...

Whose Insurance Do I Use if I Crash Someone Else’s Car?

Tuesday, November 24, 2020

- - Unlike crashing your own car, getting compensated by your insurer for crashing someone's car may be quite difficult, but not impossible. In this scenario, there are several factors to consider before your insurance...

How to Insure Your Roof with Home Insurance

Monday, November 9, 2020

Keeping you and your family safe, even in harsh weather, is one of the numerous functions of a standard roof. Just like anything of value, it is also important that your roof has adequate insurance Michigan coverage....

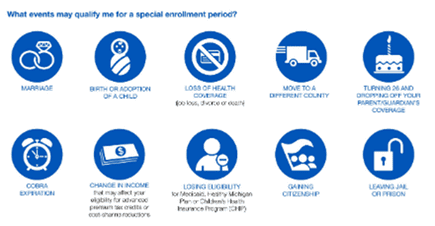

What is a Qualifying Event and Why Does It Matter?

Thursday, October 29, 2020

The terms Qualifying Event, Special Enrollment Period, and Open Enrollment Period get tossed around in conversation when discussing both employer-sponsored benefits and individual health insurance plans. The timeframes...

Rising prescription costs

Thursday, October 22, 2020